- May 25, 2017

- Posted by: tpgstaging

- Category: Blog

By: Andy Buteux, John Wildman and Don Baker

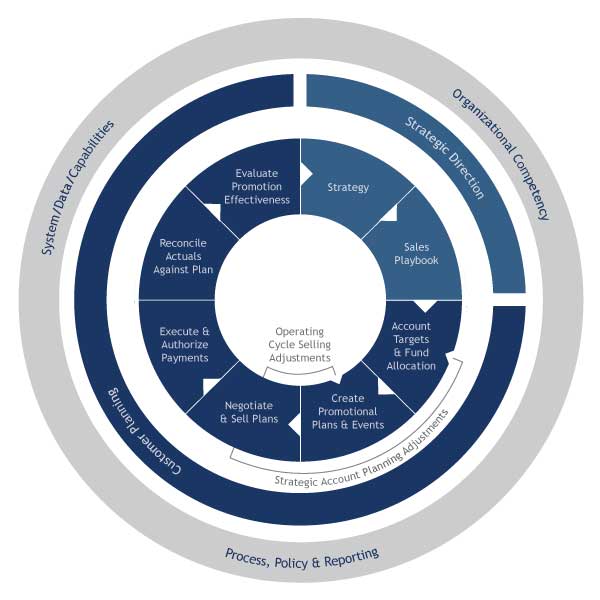

EXECUTION of the Trade Investment Roadmap and the Company’s brand and customer imperatives is delivered via the closed-loop planning process. Needless to say, the customer plan is foundational to proper execution of Trade Investment Roadmap and Company Strategy.

It is also the place where things can go off the strategic rails immediately. Ask any seasoned sales or trade manager this question, “What is the building block of the customer plan?” 95% or greater will answer – “The year-ago plan.”

In addition, many organizations exert tremendous energy creating strategic plans but do not practice the discipline needed to execute properly. In fact, most strategy is abandoned before companies really know whether it was effective or not!

Short term trends suggest a different course and the strategy hamster wheel gets rolling again toward change. So invest the time to build a plan that expresses your Trade Investment Roadmap and Corporate Strategic Imperatives.

Why Closed-Loop Matters

Systems typically shoulder the blame for a planning process that doesn’t remain “closed-loop” from strategy inception to settlement and back to strategy development. But the entire corporate trade planning approach is responsible for gaps in the closed-loop approach – Management, Process, and Systems. Closed-loop planning is an organizational term, not a system term (although that is where it is most often applied).

When it comes to Customer Trade Planning development, our goal in working with clients is to help them develop a corporate customer planning cycle that replaces the legacy process that perpetuated bad past assumptions.

In Price and Promotion Planning the closed-loop process has several important planning elements and processes, including:

- Account Targets and Fund Allocation. Assign targets, which flow from the Annual Operating Plan (also called Annual Business Plan). Allocate to the account level consistent with the strategy.

- Strategic Account Planning. Engage the customer around the strategic imperatives for win/win solutions. This is most often done high level before the year begins and may impact the final targets and investment allocation.

- Plan Negotiation and Sell-In. Manage the plan with the customer throughout the operating cycle.

- Adjust the Plan. Rewrite key elements of the plan as the year moves on.

- Close Out the Plan. Execute and authorize payments against the plan.

- Evaluate Performance. Measure price and promotion effectiveness from ongoing adjustments and archive the data for future comparison.

Most companies have many of these elements in place, or they know them and are striving to put them in place. Even so, we see the planning process break down when the following practices are not consistently executed.

Proper Funding Allocation is a challenge for many companies. Trade money obviously always makes its way into the plan each year and as we said above is often based on year ago. The problem in many cases is that the money isn’t allocated based on the strategic intent of the business. We see great effort put against the creation of fund design, customer segmentation, and brand pricing efforts. But often the plan is funded in a manner that allows for customer price and promotion practices that deviate from the intended outcome of those efforts.

In-Store Fundamentals are not thoroughly documented in a Sales Playbook. Many of the companies we work with have a wealth of knowledge about the channels and markets in which they operate and their strategic position. But often the Sales Playbook lacks meaningful depth in all areas of the 4 P’s, not just price and promotion. Pricing and promotion direction should be provided at a level that reflects the intended investment, the expected goals, any regional or channel differences and potentially a host of other elements.

Incremental Funding Management. There are times when the plan investment is well allocated but it can be undone if the company does not take a good approach. Incremental Funding should be pushed into the marketplace using key principles for approval, clear steps for tracking the investment success/failure and the ability to withdraw it from history for future planning.

Total Customer Investment Knowledge is another sorely needed area. This means a clear, accurate and operationalized means of reporting every dollar that goes to a customer. It is the CPG’s value proposition. And we are talking every dollar – not just trade investment, but shopper money, demo money, backhaul and pickup dollars. We believe CPG companies should diligently track what they spend in detention charges and slotting as well as discounts and post audit claims. All of these should be reported in component parts and made a part of the CPG company’s value proposition within the joint business plan negotiation.

So how do you stack up?

- How much money do you spend with individual Customers beyond your trade spending?

- How many Customers are following your Playbook recommendations?

- Do you have a process for Incremental funding or is it “dialing for dollars”?

Now that we have surfaced some of the most important components of the plan, next time we will start to delve into the process discipline necessary to insure delivery of the plan.

_________

Authors’ Note: This article is the third of a TPG series on Trade Management Excellence. Find the previous post here: OGSI: Your Three-Year Trade Investment Roadmap. Next up – Importance of Process, Policy, Data Management and Systems.

© 2017 The Partnering Group, Inc.