- August 22, 2016

- Posted by: tpgstaging

- Category: Blog

Authors: Don Baker, Andy Buteux, and John Wildman

So now we get to execution of the Trade Investment Roadmap and the Company’s brand and customer imperatives as delivered via the closed loop planning process. Needless to say, the customer plan is foundational to proper execution of Trade Investment Roadmap and Company Strategy. It is also the place where things go off the strategic rails immediately. Ask any seasoned sales or trade manager the question, what is the building block of the customer plan? 95% or greater will answer – The Year Ago plan. Many organizations exert tremendous energy creating strategic plans but do not practice the discipline needed to execute properly. In fact, we tell clients that most strategy is abandoned before companies really know whether it was effective or not. Short term trends suggest a different course and the strategy hamster wheel gets rolling again toward change. So invest time in building a plan that expresses your Trade Investment Roadmap and Corporate Strategic Imperatives.

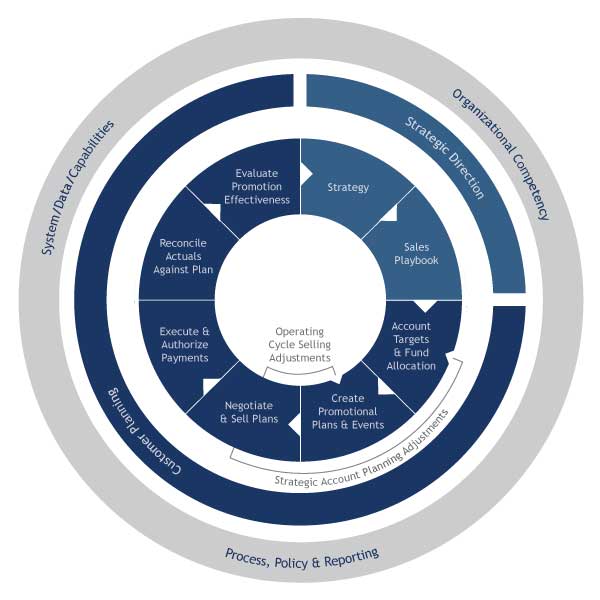

We don’t have enough time or space to discuss all of the nuances of proper Customer Trade Planning development. Our goal in working with clients is to help them develop a corporate customer planning cycle that was a closed loop process. Like the one below:

The closed loop process as it concern Price and Promotion Planning has several important planning elements, including:

- Account Targets and Fund Allocation: This is the process of assigning targets, which flow from the Annual Operating Plan (also called Annual Business Plan) and is allocated to the account level consistent with the strategy.

- Strategic Account Planning: The process of engaging the customer around the strategic imperatives for win/win solutions visit here. This is most often done high level before the year begins and may impact the final targets and investment allocation.

- Plan negotiation and sell in: Managing the plan with the customer throughout the operating cycle.

- Adjusting the plan: Rewriting of key elements of the plan as the year moves on.

- Closing the plan out: Executing and authorizing payments against the plan.

- Evaluation: Measuring price and promotion effectives from on-going adjustments and archiving purposes.

Most companies have many of these elements in place or they know them and are striving to put them in place. But even with that, we see the planning process break down when the following practices are not consistently executed.

Proper Funding Allocation is a challenge for many companies. Trade money obviously always makes its way into the plan each year and as we said above is often based on year ago. The problem is that the money isn’t allocated based on the strategic intent of the business in many cases. We see great effort put against the creation of fund design, customer segmentation, and brand pricing efforts. But often the plan is funded in a manner that allows for customer price and promotion practices that deviate from the intended outcome of those efforts.

Many of the companies we work with have a wealth of knowledge about the channels and markets in which they operate and their strategic position. But often, the In-store Fundamentals are not thoroughly documented in a Sales Playbook. Or the Sales Playbook lacks meaningful depth in all areas of the 4 P’s, not just price and promotion. Pricing and promotion direction should be provided at a level that reflects the intended investment, the expected goals, any regional or channel differences and potentially a host of other elements.

There are times when the plan investment is well allocated but it can be undone if the company does not have a good approach for Incremental Funding Management. Incremental Funding should be pushed into the marketplace using key principles for approval, clear steps for tracking the investment success/failure and the ability to withdraw it from history for future planning.

Finally, we believe Total Customer Investment Knowledge is sorely needed. Customer Investment knowledge is a clear, accurate and operationalized means of reporting every dollar that goes to a customer. It is the CPG’s value proposition. And we are talking every dollar – not just trade investment, but shopper money, demo money, backhaul and pickup dollars. We believe CPG companies should diligently track what they spend in detention charges and slotting as well as discounts and post audit claims. All of these should be reported in component parts and made a part of the CPG company’s value proposition within the joint business plan negotiation.

So how do you stack up?

- How much money do you spend with individual Customers beyond your trade spending?

- How many Customers are following your Playbook recommendations?

- Do you have a process for Incremental funding or is it “dialing for dollars”?

Now that we have risen up important components of the plan, next time we will start to delve into the discipline necessary to insure delivery of the plan.